All our customers get access to AA Exclusive rewards & discounts on other products. Plus, AA Membership & AA Car Insurance customers get exclusive discounts on their AA Home Insurance!

Home Insurance Quotes Ireland

Save €115 on your Home Insurance!‡

Why AA Home Insurance? 🏠

Protect what matters most. AA Home Insurance with Emergency Home Rescue as standard + more benefits that make it extraordinary.

Get up to 40% No Claims Discount & up to Save €115‡ when you purchase your Home Insurance online!

With home insurance products to suit every home, you can compare to find a policy that suits you best.

Exclusive for AA customers, Protect your home with 24/7 immediate response!

As an AA customer you get:

- All inclusive starter pack with smoke alarms

- Alarm verification with cameras, day and night

- 24/7 monitoring with immediate response

- Highly visible burglar deterrent sign

More about PhoneWatch:

- Over 32 years’ experience protecting over 120,000 Irish homes.

- Excellent customer service with a 4.8 / 5 star on Trustpilot and a 4.3 rating on Google.

- 96% customer rating

- Free alarm system servicing, extensive product warranty and no call-out charge.

All AA Home Insurance policies now come with Emergency Home Rescue as standard. From drains cover to failure of internal electrics, we’ve got you covered should something unexpected happen. Read More

Whether you’re working hybrid or have your home office fully kitted out, you can get cover for your personal home office equipment (i.e. equipment you own & not your employer) for up to €4,000**

Also available for those looking to renew their home insurance.

AA Home Insurance customers can claim up to €3,000 without affecting your no claims bonus**

It’s one way we’re providing customers with extra protection on what is considered one of the most important parts of any home insurance policy.

If you can’t live in your home due to a fire, damage, or another insured event, there’s no need to worry.

When the unexpected happens at home, we will cover the cost of alternative accommodation.

This benefit ensures your family has somewhere to call home for a little bit without issue.

AA Members save extra on home insurance, as well as increased cover for personal belongings and cash.** AA Members can also claim up to €6,000 without affecting your no claims bonus^

We go that extra mile to give our customers additional benefits when taking out a home insurance policy at no added cost.

You can avail of benefits like Christmas & Wedding Gifts Cover, Fire Brigade Charge Cover, Family Personal Accident & Public Liability Insurance.

Please note, the cover listed above is only available on AA common product policies (Aviva and RSA). Please see Cover Summary for more details on AA common product, AA Liberty, AA Allianz and AA AXA.

Compare Home Insurance Quotes to find the perfect cover

Discover our other home insurance products

As one of Ireland’s leading home insurance companies, The AA team knows there is more to homeownership than bricks and mortar.

With that in mind, we have our own selection of home insurance products to help you protect what matters most, with products that suit your needs.

Our most popular home insurance products include:

24/7 Emergency Home Rescue

24/7 Emergency Home Rescue

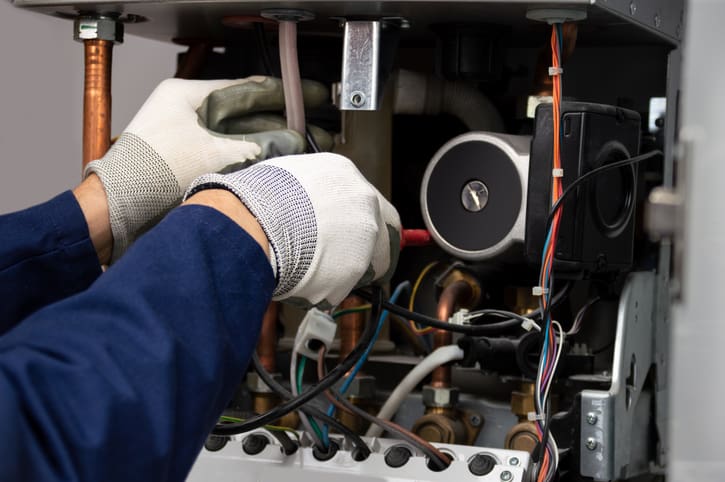

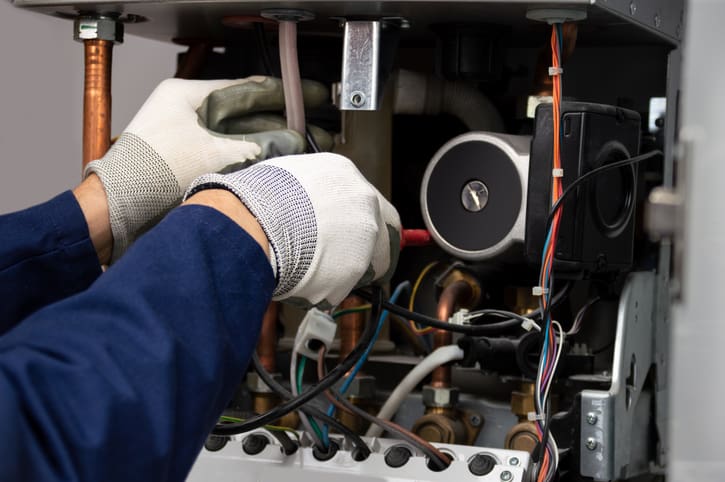

When it comes to home emergencies we know when it rains it pours. With AA, Home Insurance policies now come with emergency home rescue cover as standard. From plumbing issues, to heating or electricity problems, you can enjoy your home knowing help is at hand for these household emergencies without affecting your no claims bonus¹

Read more

Kitting out your home takes time and substantial investment. AA home contents insurance protects you from any loss or damage to all your essential belongings.

Our contents cover is also there for the minor inconveniences you wouldn’t even think of, like protecting the contents of your fridge & freezer, power cuts, and even when you’re on jury service.

Get a quote

As a landlord, the inability to look after your property daily can feel like more risk is involved.

Anyone acting as a landlord can get protection against loss or damage to a rental property with AA landlord insurance, which covers everything from third-party claims to water mage.

Get a quote

Protect your home away from home with AA holiday home insurance.

We cover any third-party claims, water damage and even up to €1,000 in loss of oil for new and existing AA customers.

Give yourself peace of mind, with third-party claims, and make sure your holiday home (and outside contents) gets protected with our help.

Get a quoteWhat AA Customers ask most about Home Insurance

The cost of Home Insurance depends on a number of different things, like the area you live, the amount you want to insure your buildings and contents for and whether you want to specify any items to your policy. We offer a €60 discount when you get a home insurance quote online.

Most Home Insurance policies are set up at the time the property is purchased, as most mortgage providers have this as a requirement when securing a loan on the property. But anytime of the year is a great time to set up a policy with The AA. Plus, we offer a €60 discount when you get a home insurance quote online.

The length of a claim can vary depending on the type of claim and the severity of the damage. With AA Home Insurance policies we include cover for Alternative Accommodation, so if the worst happens and you have to temporarily leave your Home while repairs are being carried out, you have the piece of mind you’re covered for the costs of your temporary accommodation.

Claims can have an impact on the cost of your insurance depending on the settlement amount and type of claim. With AA Home Insurance policies, we include no claims bonus protection, so claims up to €3,000* will not impact your no claims bonus.

*This is increased to €6,000 for AA Roadside Rescue Members. Only available with AA Aviva & RSA policies.

Here at The AA we’ve always cared more about people. That’s why we make sure that our AA Home Insurance covers you and not just your home. With benefits including Family Personal Accident Cover and No Claims Discount Protection*, The AA protects the things that matter most to you.

* Only available with AA Aviva & RSA policies.

While most Home Insurance policies cover both the buildings and contents of a property together, Contents Insurance would focus on what is inside the home only. This is a perfect cover for Tenants and Homeowners where the building itself is insured separately. It can be expensive to kit out your home or apartment, so with Contents Insurance, you will have cover for the personal possessions, furniture and electronics that make your house your home.

Home Insurance overall has two levels of cover, Buildings and then Contents Cover. Together, Buildings and content insurance is essential for protecting both your home building and personal belongings. Investing in a home is a significant financial commitment that should be safeguarded by insuring it for its accurate value to avoid becoming underinsured. Plus, your personal items hold monetary worth and insuring your home and contents helps ensure that these items are protected in case of any loss or damage.

With AA home Insurance, you’ll have peace of mind 🙌

With AA home Insurance, you’ll have peace of mind 🙌

We’ve been trusted by our customers for over 100 years.

Enjoy your home, without the unexpected worries.

Rated ‘Great’ by our customers on our latest review. You’re in good hands.

Contact our Home Insurance specialists ✨

Contact our Home Insurance specialists ✨

Get in touch with one of our home insurance specialists & we’ll take care of the rest. RelAAx!

Call 01-6740444 Get an Online QuoteAlready Insured with us? 🤝

Hopefully you won’t need to get in touch, but should something change. We’re here.

Switch to AA Today‡/+ Min premium of €218 & 5 years claims free. €115 discount applies to new business home insurance customers that currently hold an active AA Membership or Car Insurance policy & is only available on policies underwritten by AA Aviva / RSA. New business customers outside of this criteria can obtain a €60 discount. Savings are based on average customer premiums between 01/01/2023 – 30/09/2023. Acceptance criteria, T&C’s apply.

**Available on owner occupied policies only. Acceptance criteria, terms and conditions apply.

***Only available with AA Aviva & RSA policies.

^Acceptance criteria, terms and conditions apply.

¹Cover up to €250 per emergency. Maximum 4 emergencies per 12 month period of insurance.

∞A fully installed home security alarm system may qualify you for a reduction in your Home Insurance premium. Purchase AA Home Insurance & get Phone Watch house alarm pack and install for only €39 (RRP €99). Any additional fees charged at standard pricing. Monitoring fees apply. 12 month contract applies.Offer ends April 30. Cannot be used in conjunction with another offer.