Minister for Finance Paschal Donohoe and Minister for Public Expenditure and Reform Michael McGrath delivered Budget 2022 on Tuesday 12th October, which is a package that sees the Government attempt to tackle the rising cost of living. The total budget package is €4.7 billion.

So what does Budget 2022 mean in terms of public transport, fuel prices, motor tax and electric vehicle use? AA Ireland has broken it down for you:

Transport and Travel

Minister Michael McGrath announced that €1.4 billion is being allocated to developing public transport, including projects like BusConnects, MetroLink and DART+, as well as EV grants.

Young adults aged between 19 and 23 will be eligible for a 50 percent discount on fares across the network through a “youth travel card”. It will apply to intercity buses and trains, and local links including buses, the Luas and DART.

The move is designed to encourage greater use of public transport. The Government is hoping that young people, especially those living in urban areas, will stick to public transport as they get older, and be less likely to purchase a car.

“It is welcome to see a younger audience being encouraged into public transport, but outside of Dublin, this will be a moot point for some, who will have no choice but to remain in their cars,” says AA Ireland Head of Communications, Paddy Comyn.

The measure will start halfway through next year and is expected to cost €25 million for 2022.

Other measures announced in Budget 2022 were:

- €30 million from the Covid recovery package for maintenance of roads.

- €1.4 billion for the road projects already approved in the NDP.

- €360 million for active travel and greenways.

Fuel prices

Minister for Finance Paschal Donohoe announced a rise in the cost of all carbon-based fuels, including petrol and diesel.

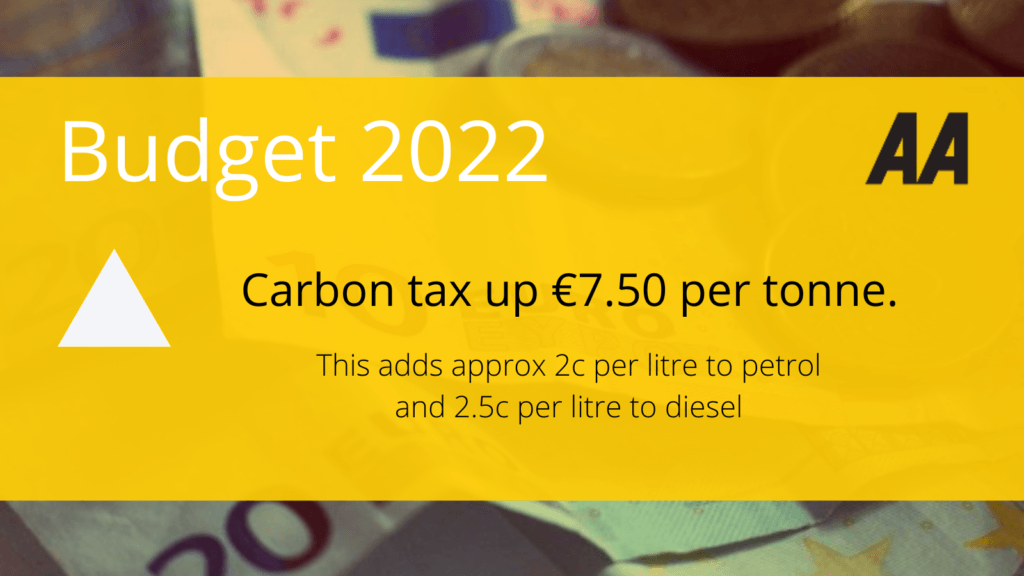

Carbon tax will increase by €7.50 per tonne, as part of efforts to reduce greenhouse gas emissions by 7 percent per year.

This adds approx. 2 cent per litre to petrol, and 2.5 cent per litre for diesel.

So a 60-litre tank of diesel will rise by €1.48, while a 60-litre tank of petrol will jump up by €1.28.

“Increases in the price of petrol and diesel were expected – but this is on the back of what is a 25 percent increase in prices of petrol and diesel over the past 12 months. Irish motorists are already paying around 60 percent in tax at the pumps for their fuel,” says Comyn.

“For some motorists, moving into an EV is as yet too far a stretch, and they have no choice but to now pay more to get around, as the public transport network remains imperfect, especially outside of the capital,” he continued.

There will also be a €5 increase in the fuel allowance. This will bring it to €33 a week and the payments will be issued to eligible social welfare recipients.

Electric Vehicles

Ireland has set targets of having around 1 million electric vehicles on our roads by 2030. This year, EVs account for 15 percent of all new car purchases in Ireland.

It was announced in Budget 2022 that increased supports will remain in place for EVs. €100 million will now be provided over the course of 2022, almost double the level of funding in 2021.

The supports will include:

- Fully electric vehicles priced under €50,000 will continue to get a Vehicle Registration Tax (VRT) exemption of €5,000 until the end of 2023.

- The Benefit-in-Kind (BiK) tax exemption for battery electric vehicles will be extended to 2025 and this measure will take effect from 2023. For BIK purposes, the original market value of an electric vehicle will be reduced by €35,000 for 2023; €20,000 for 2024; and €10,000 for 2025.

- Continuation of the purchase grant scheme at existing levels for fully electric passenger cars and vans, and the refocusing of exchequer funding on zero tailpipe emission vehicles.

- Continuation and expansion of the home charging infrastructure scheme to include multi-unit dwellings.

- Continuation of a grant scheme for taxi and hackney drivers, of an alternatively fuelled heavy goods vehicles purchase grant scheme and of the Low Emission Vehicle Toll Incentive Scheme.

- There will be an introduction of a revised scheme for public point charging, of a new scheme for electric vans and of a new scheme for destination charging.

However, the Department of Transport has announced that from January 1st 2022, the Plug in Hybrid Vehicle (PHEV) purchase grant of €2,500 will no longer exist. All new applications for PHEV grants will only be accepted for vehicles delivered, registered, and taxed before the end of December 2021.

Any PHEV or Battery Electric Vehicle (BEV) (above the 60k value threshold) which has an existing grant offer and was due to be delivered in 2021 but has met unforeseen delays due to semi-conductor shortage, may avail of an extension to 31st March 2022.

“While we are very much welcome the official announcement of the extension of the supports for electric vehicles (EVS) we feel that the announcement of the cessation of PHEV grants in January, which will be just six months after they were halved from €5,000 to €2,500 is premature and will not encourage the move away from petrol or diesel cars,” says Comyn.

“PHEVs are a stepping stone for many people away from petrol and diesel cars and for some people, a BEV doesn’t quite yet meet their needs just yet and a PHEV would have given many motorists the natural progression to move into a Battery Electric Vehicle.”

“We acknowledge that the grant money will be used to increase the penetration of electric vehicles, but The AA feels that this should have been at least extended to the end of June 2022, to allow motorists who were undecided to order a new car for next year and still take into account any delays due to the global shortage of semiconductors,” adds Comyn.

Motor Tax

A revised motor tax system was also announced. This means that VRT rates will increase for vehicles emitting more than 110g of CO2 per km. It will run as follows:

- 1 percent increase in VRT for bands 9-12 (111-130g/km)

- 2 percent increase for bands 13-15 (131-145g/km)

- 4 percent increase for bands 16-20 (146g/km)

“We were aware that there would be increased taxation in this Budget and it does appear that there are steps in the right direction in terms of keeping EV grants in place. But, there is a worry that this is being paid by lower income motorists being forced to stay in older cars,” states Comyn.

“The AA welcomes the promised investment in public transport with investment in areas such as BusConnects, MetroLink and the DART+ Programme, but asserts that there shouldn’t have been further increases in petrol and diesel prices until these alternatives were in place,” he adds.

“It is crazy to assume that any motorist would prefer to sit in traffic daily, but many of them quite simply do not have an alternative option to their car yet.”